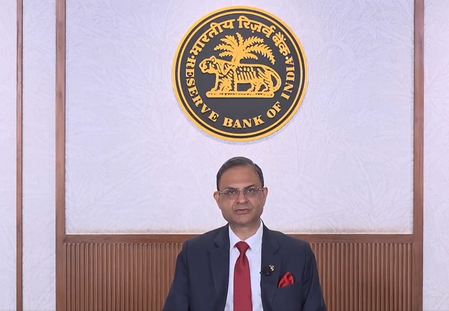

Mumbai: Reserve Bank of India (RBI) Governor Sanjay Malhotra on Friday announced that the Monetary Policy Committee (MPC) has unanimously decided to retain the policy repo rate at 5.25 per cent while continuing with its neutral monetary policy stance.

Malhotra stated that the decision to maintain the current policy rate was taken after a detailed assessment of prevailing macroeconomic conditions and the future economic outlook. He noted that global economic challenges have intensified since the last monetary policy review in December, but recent trade agreements signed by the government are expected to support India’s economic prospects.

The RBI has chosen to continue with a neutral policy stance, which means maintaining a balance between controlling inflation and supporting economic growth without either tightening or loosening liquidity significantly. The central bank has adopted this approach to allow the impact of previous monetary easing measures to fully transmit through the economy and to assess evolving global trade developments.

The Governor highlighted that inflation remains under control and is below the RBI’s tolerance band. The central bank has revised its Consumer Price Index (CPI) inflation projections for the first two quarters of 2026-27 to 4 per cent and 4.2 per cent, respectively. He explained that the slight upward revision is primarily due to the anticipated rise in precious metal prices, although overall inflation is expected to remain within acceptable limits.

Malhotra also expressed confidence in India’s economic growth outlook, stating that domestic demand and structural factors are likely to drive expansion in the coming months.

In its December policy review, the MPC had reduced the repo rate by 25 basis points from 5.5 per cent to 5.25 per cent to support economic growth. Prior to that, the committee had kept rates unchanged during its August and October meetings to manage inflationary pressures.

Earlier in the year, between February and June, the RBI had implemented cumulative rate cuts of 100 basis points, reducing the repo rate from 6.5 per cent to 5.5 per cent. The central bank believes the impact of those rate reductions is still being transmitted through the financial system.

Lower policy rates typically increase liquidity in the banking sector and reduce borrowing costs for consumers and businesses, encouraging higher spending and investment, which in turn supports economic growth. However, the effectiveness of such rate cuts depends on how efficiently commercial banks pass on the benefits to borrowers.

With inputs from IANS